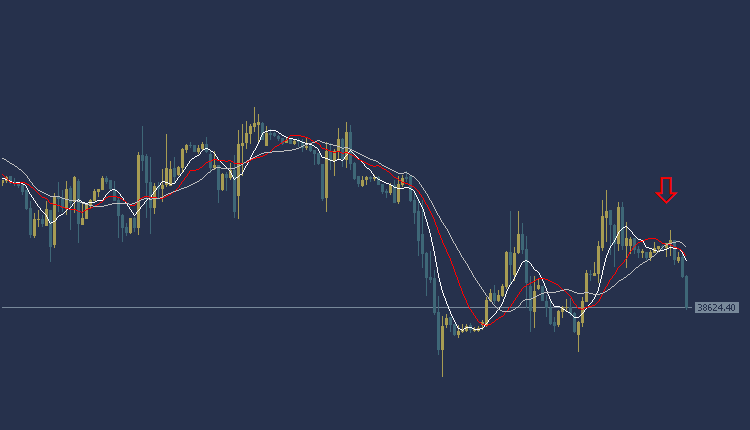

Dow Jones US30 Technical Analysis is trading at $38624. According to technical analysis, the current trend is a downward trend in the American index prices. The price of the American index appears below most of the intersections of the moving averages, and the MACD indicator also shows negative signs in anticipation of the release of the US non-agricultural employment change index.

Accordingly, we expect the index to take a downward trend, so we will sell from the decline to the level of 38557, targeting the level of $38446 as a profit-taking target. To ensure risk control, it is recommended to set the stop loss point at the $38,752 area.

Dow Jones US30 Technical Analysis: On the other hand

In case the $38752 buy zone is broken, the target is $38826.

Dow Jones US30 Technical Analysis: resistance and support

- Second resistance: 38681.30

- Initial resistance: 38663.20

- Pivot level: 38649.12

- First support: 38600.77

- Second support: 38573.80

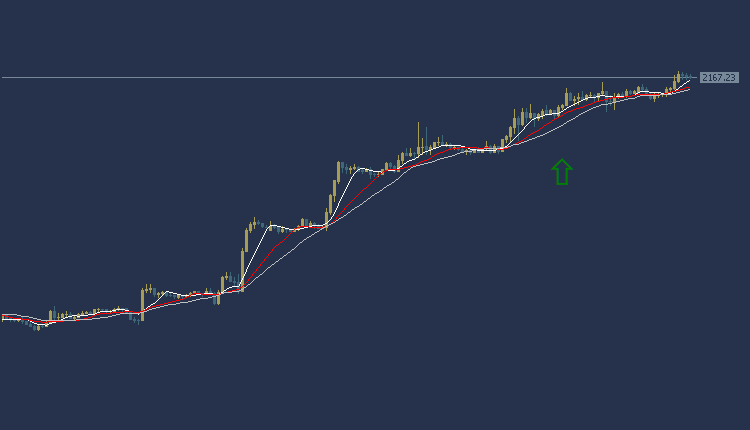

Gold Technical Analysis: bullish trend

Gold Technical Analysis: The price of gold is trading today at $2167 per ounce. Trading appears in an upward trend, as the price of gold is trading above the intersections of the Moving Average indicators. As for the MACD indicator, it indicates positive signals with anticipation of the release of the Non-Agricultural Employment Change Index.

Accordingly, we can look to buy from the rise to the price of $2175 per ounce, and target the $2188 per ounce area to take profits, while setting the $2130 per ounce area as a stop loss.

Gold Technical Analysis: On the other hand

On the other hand, if the $2159 per ounce selling area is broken, the price may head to the $2150 per ounce area.

Gold Technical Analysis: resistance and support levels

- Second resistance: 2172.22

- First resistance: 2170.40

- Pivot level: 2168.12

- First support: 2165.78

- Second support: 2163.70

EURUSD Technical Analysis: an upward trend

EURUSD Technical Analysis, the Euro/Dollar is in a weak upward trend during the American session. The Euro/Dollar is trading at $1.0933, where prices appear to be trading above most of the moving average intersections shown on the chart. The MACD indicator also indicates a positive trend with anticipation of the release of US data, the most important of which is the non-agricultural employment change index. Accordingly, we can look to buy from the rise to the price of $1.0942, and the target could be the $1.0956 area. It is also recommended to choose the $1.0912 area as a stop loss point to control risk.

EURUSD Technical Analysis: On the other hand

On the other hand, if the $1.0912 sell area is broken, the target is $1.0900.

EURUSD Technical Analysis: resistance and support levels

- Second resistance: 1.0957

- First resistance: 1.0948

- Pivot level: 1.0940

- First support: 1.0923

- Second support: 1.0914

GBPUSD Technical Analysis: bullish trading

GBPUSD Technical Analysis today is in an upward trend during the Asian session. The pound is trading at $1.2829, and trading appears above most of the moving average intersections. The MACD indicator also indicates a positive trend with anticipation of the release of the US non-agricultural employment change index. Accordingly, we can look to buy from the rise to the price of $1.2843, and the target could be the $1.2878 area. It is also recommended to choose the $1.2771 area as a stop loss point to control risks.

GBPUSD Technical Analysis: on the other side

On the other hand, if the sell area at $1.2771 is broken, the pound price may head towards the $1.2746 level.

GBPUSD Technical Analysis: resistance and support levels

- Second resistance: 1.2857

- First resistance: 1.2849

- Pivot level: 1.2833

- First support: 1.2820

- Second support: 1.2811