NZDUSD Technical Analysis: The NZDUSD is trading in a weak bearish trend today during the American session. The NZDUSD price is trading at 0.6082, and trading appears below most of the moving average intersections. The MACD indicator also indicates a weak negative signal.

Accordingly, we can look to sell from a drop to 0.6071, and the target could be the 0.6059 area. It is also recommended to choose the 0.6100 area as a stop loss point to control risks.

NZDUSD Technical Analysis: On the other hand

On the other hand, if the stop loss area at 0.6100 is broken, the New Zealand price may head towards the 0.6111 level.

NZDUSD Technical Analysis: Resistance and Support:

- Second resistance: 0.6093

- First resistance: 0.6089

- Pivot level: 0.6085

- First support: 0.6076

- Second support: 0.6070

USDJPY Technical Analysis: trading in an upward trend

USDJPY Technical Analysis today in an upward trend during the American session. The price of the USDJPY is trading at 150.56, and trading appears above most of the moving average intersections. Also, the MACD indicator indicates a weak positive trend

Accordingly, we can look to buy from the rise to the price of 150.84, with the targeted target being the 151.33 area. It is also recommended to choose the 149.89 area as a stop-loss point to control risks.

USDJPY Technical Analysis: on the other hand

On the other hand, if the stop loss area at 149.89 is broken, the USDJPY price may head towards the 149.45 level.

USDJPY Technical Analysis: resistance and support levels

- Second resistance: 150.98

- First resistance: 150.78

- Pivot level: 150.62

- First support: 150.20

- Second support: 150.00

USOIL Technical Analysis: Oil prices rise

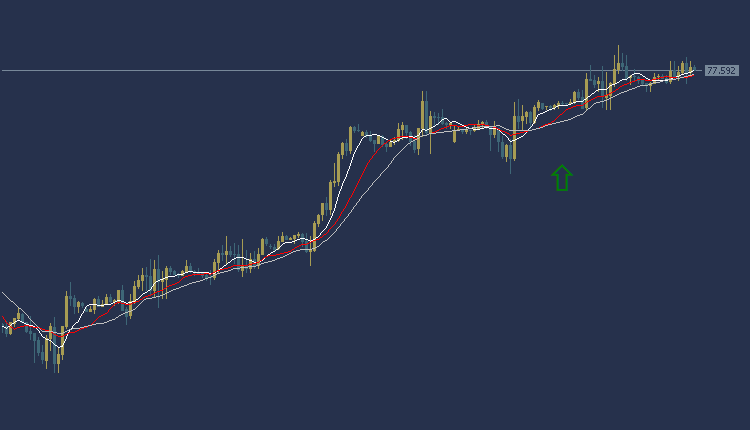

USOIL Technical Analysis, in the global oil market, the price is trading at the area of $77.56 per barrel. According to technical analysis, the current trend indicates an upward trend with prices trading above the intersections of the moving average, and the MACD indicator also shows the emergence of a positive trend signal.

Accordingly, buying can rise to the price of 78.16, and we will target $78.91 per barrel as a profit-taking target. To ensure risk control, it is recommended to set a stop loss point at the $76.31 per barrel area.

USOIL Technical Analysis: On the other side

If the stop loss area at 76.31 per barrel is broken, targeting the additional support level at $75.70 per barrel could be achieved.

USOIL Technical Analysis: resistance and support levels

- Second resistance: 78.20

- First resistance: 77.99

- Pivot level: 77.80

- First support: 77.30

- Second support: 77.00

Dow Jones US30 Technical Analysis: is trading in a downward trend

Dow Jones US30 Technical Analysis, the Dow Jones Index is trading at $38391. According to technical analysis, the current trend is a downward trend in the American index prices. The price of the American index appears below most of the crossings of the moving averages, and the MACD indicator also shows negative signs

Accordingly, we expect the index to take a downward trend, so we will sell from the decline to the 38287 level, and we will also target the $38186 level as a profit-taking target. To ensure risk control, it is recommended to set the stop loss point at the $38541 area.

Dow Jones US30 Technical Analysis: On the other hand

If the stop loss area at $38541 is broken, targeting the additional support level at $38624 could be achieved.

Dow Jones US30 Technical Analysis: resistance and support

- Second resistance: 38455.30

- Initial resistance: 38432.12

- Pivot level: 38410.06

- First support: 38370.88

- Second support: 38354.90